Investors who are risk averse or who have a low appetite for risk tend to opt for investment avenues that can keep their principal amount safe but also yield good returns for them. When making investment decisions, a liquid fund or a bank fixed deposit could be popular choices for such investors.

A liquid fund is a debt fund composed of commercial papers, treasury bills, certificates of deposit, etc. Fixed deposits (FDs), offered by commercials banks and Non-Banking Financial Companies (NBFCs), are investment instruments wherein an individual can deposit a lumpsum amount for a fixed period at a predetermined rate of interest.

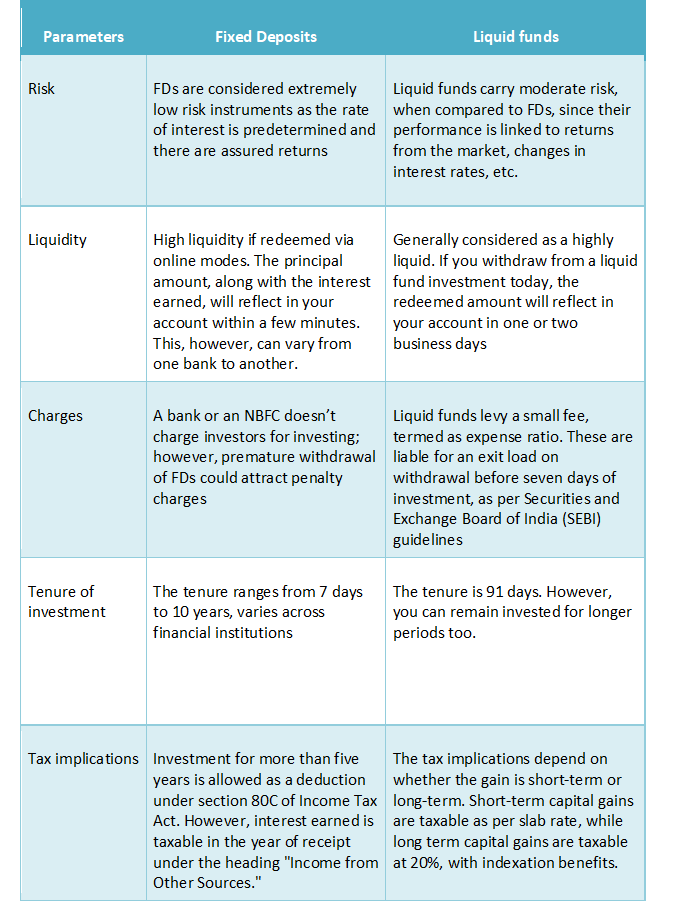

When choosing between a liquid fund and a fixed deposit, there are various factors to be considered before deciding which investment avenue is better suited for your investor profile.

A comparison between liquid funds and FDs

Choosing between liquid funds and fixed deposits

Choosing between liquid funds and fixed deposits

While deciding upon an investment avenue from either of the two, you should take into account the points mentioned above and how they each fit into your overall scheme of things. Any investment decision should be taken after analyzing your own financial goals, the kind of investor you are, and your appetite for risk.

However, when it comes to wealth creation, be it short-term or long-term, you need not limit yourself only to these two avenues. There are other investment instruments like stocks and equity, debt and hybrid mutual funds that you can consider to fulfill your wealth creation objective. It is always prudent to explore such options with the help of an expert so that your investment decisions yield good returns.

Begin your wealth creation journey by reaching out to a financial expert today.