How your credit score is determined

Credit score data permits banks to check a credit candidate to check whether the person merits the danger of profiting credit. All things considered, credit organizations are a business and need to benefit from their interests regarding loaning their cash assets. It is reasonable business practice that they attempt to loan it to individuals who are mindful enough to repay them later.

Banks and credit establishments attempt to evaluate each credit application by taking a gander at the candidate’s credit score data. Through it, these foundations will have the option to decide whether a candidate merits the hazard. The credit score is gotten from data dependent on the past credit exercises of the candidate just as other related data. All these can be found on the candidate’s credit report.

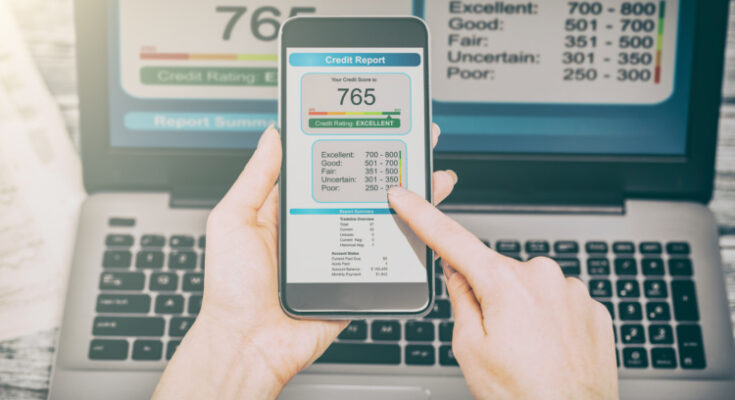

Your Credit Score

A credit score is determined utilizing the different data contained in the credit report. Various variables become possibly the most important factor when a credit score is determined. A structured recipe is utilized by credit announcing organizations to think of the credit score. The equation considers the data from the credit report, both great and awful, to think of the proper score.

All together for this score to be determined, the credit report must have, as a base, one record which is at any rate a half year old and one that has been refreshed for a similar period. This will guarantee that there is sufficient ongoing data in the credit report from which to base the computation.

Installment History

Installment history represents around 35 percent of the credit score. This incorporates installments made on time just as late installments. Open records can discover their way into the credit report, for example, late or non-installments, insolvencies, claims, and so forth. These all might be viewed as when registering the credit score.

Measure of remarkable credit

The measure of credit that you have profited in the past records for around 30 percent of the credit score. Not exclusively is the aggregate sum viewed yet in addition the sum obtained from various records. The equalizations on specific records may likewise influence the credit score. Keeping up a little parity for instance, will positively affect the credit report and may help keep your credit score up.

Credit History

The length of your credit history represents 15 percent of your credit score. Your most seasoned record and the normal age of your different records are mulled over while computing your credit score. Additionally considered is the time span that has gone since you have utilized certain records.

The quantity of new credits benefited represents around 10 percent of your credit score. This incorporates the time allotment that has gone since you have opened another record. The quantity of credit demands in a one year time frame is likewise thought of.

The different kinds of credit that you have benefited represents 10 percent of the data that goes into the computation of the credit report. Spinning credit, for example, credit card obligations and individual advances or home loans, is likewise considered.

End

The recipe utilized by the distinctive credit revealing offices in computing your credit score do differ somewhat from organization to organization however they all follow a fundamentally the same as procedure.